Eccles discusses in a Harvard Business Review interview, there’s been a push toward new accounting standards to better measure material information related to sustainability. So, a business might need to report a pending lawsuit to the same degree it reports its revenues because both pieces of information could impact investors’ view of the company.įor example, with a bigger investor focus on sustainability nowadays, a business might want to include information related to its environmental, social, and corporate governance (ESG) practices to assure shareholders that the business is a sustainable investment. Material items can be financial (measurable in monetary terms) or non-financial.

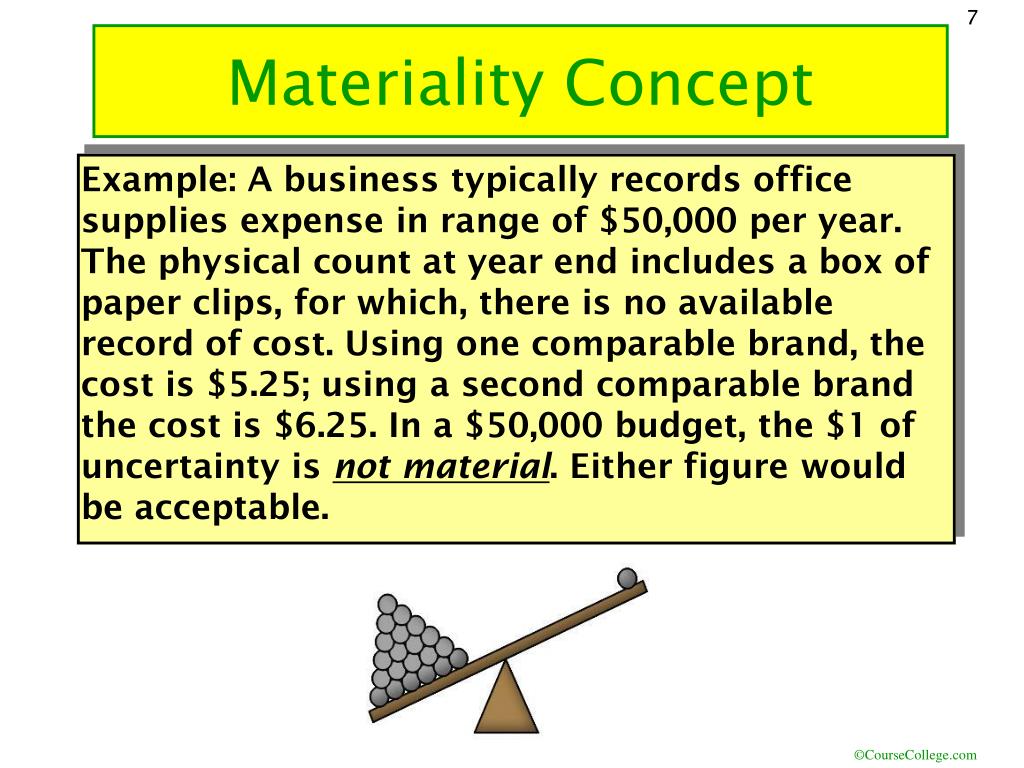

For example, while a small, family-owned grocery store may need to record a small expense for promotional coupons, Whole Foods may not need to record a large one for a similar offer. What’s considered to be material and immaterial will differ based on the size and scope of the firm in question. If a transaction or business decision is significant enough to warrant reporting to investors or other users of the financial statements, that information is “material” to the business and cannot be omitted. Materiality is an accounting principle which states that all items that are reasonably likely to impact investors’ decision-making must be recorded or reported in detail in a business’s financial statements using GAAP standards.Įssentially, materiality is related to the significance of information within a company’s financial statements.

MATERIALITY COST PRINCIPLE OF ACCOUNTING FREE

Here’s an overview of what materiality is and examples of materiality in action.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today. Materiality is a key accounting principle utilized by accountants and auditors as they create a business’s financial statements. Luckily, the financial accounting concept of materiality makes this easier. Sometimes it can be difficult to know what should be included in these financial statements and what can be omitted. Many other factors, including whether the item in question involves an unlawful transaction, should also be considered when determining materiality.Organizations rely on financial statements to record historical data, communicate with investors, and make data-driven decisions. Materiality is not only concerned with the monetary amount of an item, but also with the nature of the item in question. This is because while £5,000 may be considered an immaterial amount for a multinational corporation, it could be considered a very material amount for a small business.

MATERIALITY COST PRINCIPLE OF ACCOUNTING HOW TO

How to determine materialityĭetermining what is a material or significant amount can require professional judgment. This is because the materiality principle notes that investors, creditors, and other interested parties will not be misled by the immediate expensing of the £20 table. The materiality principle in turn says that you may expense the whole £20 the year that the table is purchased however – so you do not have to depreciate the table by £2 over each of the next ten years.

One example of an immaterial accounting instance would be the expensing of a £20 table that has a useful life of ten years.Īnother accounting principle – the matching principle – would require that the company record the table as an asset and then depreciate its cost over the 10 year useful life. The point of the materiality principle is that if an amount or transaction is immaterial in the grand scheme of the company, then it may not need to be treated in the same manner as material transactions. Under the materiality principle, if another accounting principle is ignored, then the net income of the company must not be significantly affected and the financial statements cannot be impaired. The materiality principle outlines that accountants are required to follow generally accepted accounting practices except where it makes no difference if the rules are ignored and when doing so would be exceedingly expensive or difficult. Make sure yours are in order with Debitoor. Starting and maintaining solid, professional accounting practices is essential for the growth of a business. The materiality principle expresses that a company may violate another accounting principle if the amount in question is small enough that the financial statements will not be misleading Materiality Principle – What is the materiality principle?

0 kommentar(er)

0 kommentar(er)